Our Home Renovation Loan PDFs

Our Home Renovation Loan PDFs

Blog Article

Get This Report on Home Renovation Loan

Table of ContentsAll About Home Renovation LoanThe Only Guide for Home Renovation LoanHome Renovation Loan - TruthsIndicators on Home Renovation Loan You Should KnowUnknown Facts About Home Renovation Loan

If you were just thinking about move-in prepared homes, making a decision to buy and remodel can increase the pool of homes offered to you. With the ability to fix points up or make upgrades, homes that you might have previously overlooked now have potential. Some houses that call for upgrades or renovations may also be available at a lowered price when compared to move-in all set homes.This implies you can borrow the funds to buy the home and your prepared improvements all in one lending. This also helps you save money on closing costs that would certainly take place if you were obtaining an acquisition finance and a home equity finance for the repairs independently. Depending on what remodelling program you pick, you might be able to increase your home value and suppress charm from renovations while likewise developing equity in your home.

The rates of interest on home restoration financings are normally less than individual car loans, and there will certainly be an EIR, understood as effective rate of interest, for every single restoration finance you take, which is costs along with the base rates of interest, such as the management cost that a financial institution may charge.

Rumored Buzz on Home Renovation Loan

If you have actually only obtained a minute: A renovation car loan is a funding option that aids you better manage your cashflow. Its reliable passion price is reduced than various other usual funding options, such as bank card and personal finance. Whether you have actually just recently purchased a new home, making your home extra helpful for hybrid-work arrangements or designing a nursery to invite a brand-new baby, restoration plans may be on your mind and its time to make your strategies a reality.

A restoration lending is suggested only for the funding of remodellings of both brand-new and present homes. home renovation loan. After the lending is approved, a dealing with cost of 2% of authorized car loan amount and insurance policy premium of 1% of approved funding amount will certainly be payable and subtracted from the accepted financing quantity.

Adhering to that, the funding will be paid out to the specialists via Cashier's Order(s) (COs). While the optimum number of COs to be provided is 4, any type of additional CO after the first will incur a charge of S$ 5 and it will certainly be deducted from your assigned funding maintenance account. Additionally, charges would additionally be sustained in case of termination, pre-payment and late repayment with the charges revealed in the table below.

Not known Incorrect Statements About Home Renovation Loan

Moreover, site sees would be carried out after the disbursement of the loan to guarantee that the lending earnings are made use of for the stated restoration works as listed in the quotation. home renovation loan. Really usually, improvement finances are contrasted to individual financings however there are some benefits to secure basics the former if you need a funding particularly for home restorations

If a hybrid-work setup has now become an irreversible feature, it may be great to consider refurbishing your home to develop an extra work-friendly setting, allowing you to have a designated job area. Once more, a remodelling funding can be a beneficial monetary device to plug your money flow gap. Restoration financings do have an instead stringent usage plan and it can just be utilized for restorations which are long-term in nature.

One of the biggest mistaken beliefs about remodelling funding is the viewed high rate of interest rate as the released passion price is higher than personal financing.

The Best Guide To Home Renovation Loan

You stand to appreciate an extra eye-catching passion price when you make environmentally-conscious choices with the DBS Eco-aware Restoration Finance. To certify, all you need to why not find out more do is to satisfy any 6 out of the 10 items that are applicable to you under the "Eco-aware Renovation List" in the application kind.

Or else, the steps are as follows. For Solitary Applicants (Online Application) Step 1 Prepare the called for papers for your remodelling lending application: Checked/ Digital billing or quotation authorized by professional and applicant(s) Earnings Files Evidence of Ownership (Forgoed if restoration is for residential property under DBS/POSB Home mortgage) HDB or MCST Remodelling Authorization (for applicants that are owners of the assigned specialist) Please keep in mind that each data dimension ought to not go beyond 5MB and acceptable layouts are PDF, JPG or JPEG.

Getting The Home Renovation Loan To Work

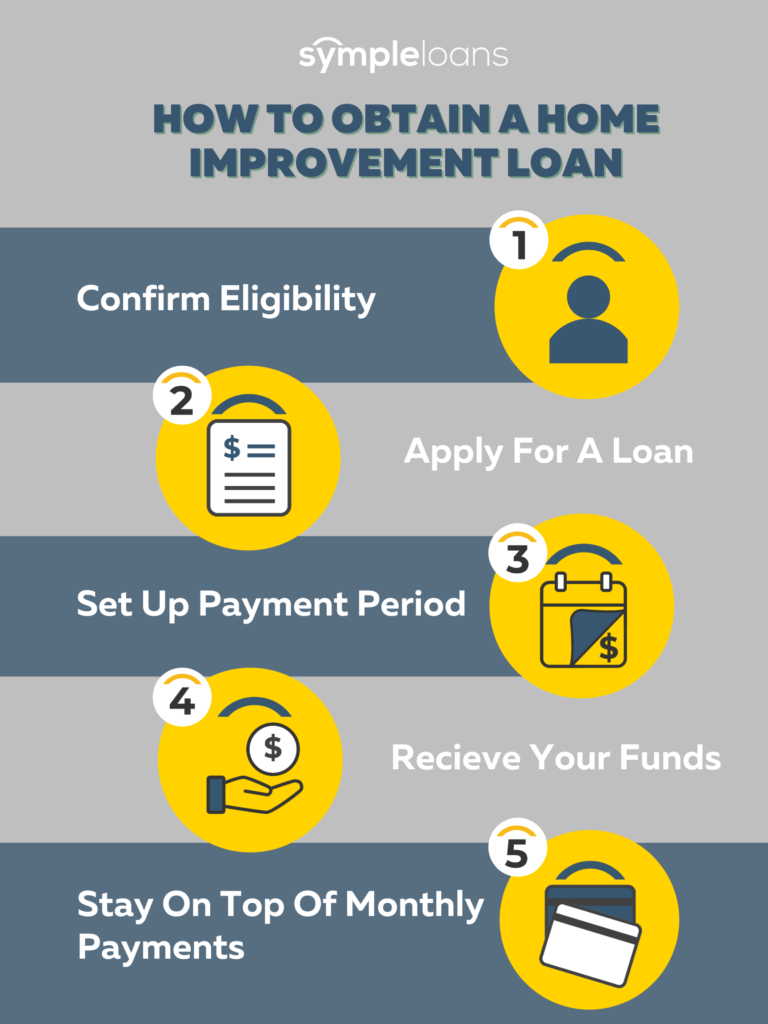

Implementing home restorations can have countless positive impacts. You can raise the value of your residential property, reduce utility expenses, and enhance your lifestyle. Getting the best home restoration can be done by utilizing one of the several home remodelling car loans that are available to Canadians. Even much better, these funding alternatives are available at some of the best financing rates.

The drawback is that many of these homes call for upgrading, in some cases to the entire home. This can be a home equity loan, home line of credit rating, home refinancing, or various other home money choices that can give the money required for those revamps.

Home restorations are feasible through a home improvement funding or another line of credit score. These kinds of car loans can offer the homeowner the capability to do a number of various things.

Report this page